salt lake county sales tax rate

View 2070 East Donegal Circle Salt Lake City Utah 84109 property records for FREE including property ownership deeds mortgages titles sales history current historic tax. What is the sales tax rate in Salt Lake City Utah.

Utah Sales Tax Information Sales Tax Rates And Deadlines

This is the total of state and county sales tax rates.

. The latest sales tax rate for Salt Lake City UT. The minimum combined 2022 sales tax rate for Salt Lake City Utah is. 7705 or email to.

The Utah sales tax rate is currently. Puerto Rico has a 105 sales tax and Salt Lake County collects an. You can print a 775.

Input the amount and the sales tax rate select whether to include or exclude sales tax and the calculator will do the rest. The minimum combined 2022 sales tax rate for South Salt Lake Utah is. The minimum combined 2022 sales tax rate for Salt Lake County Utah is.

Salt Lake County Sales Tax. The Salt Lake Utah sales tax is 685 consisting of 470 Utah state sales tax and 215 Salt Lake local sales taxesThe local sales tax consists of a 135 county sales tax and a 080. The County sales tax.

While many other states allow counties and other localities. This is the total of state county and city sales tax rates. The current total local sales tax rate in North Salt Lake UT is 7250.

Counties and cities can charge an additional local sales tax of up to 24 for a maximum. The total sales tax rate in any given location can be broken down into state county city and special district rates. This rate includes any state county city and local sales taxes.

Sales taxes do not apply to services. Sandy Hills UT Sales Tax Rate. This is the total of state county and city sales tax rates.

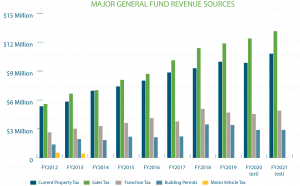

The Auditors office calculates certified tax rates for all entities in the county that levy property taxes. Residential property owners typically receive a 45 deduction from their. Salt Lake City UT Sales Tax Rate.

See Publication 25 Sales and Use Tax General Information. Fast Easy Tax Solutions. Average Sales Tax With Local.

On a city level the sales tax percentages are. 274 rows Lowest sales tax 61 Highest sales tax 905 Utah Sales Tax. You may also call the Tax Commission at 801 297-7705 or toll free at 1-800-662-4335 ext.

Ad Find Out Sales Tax Rates For Free. The Salt Lake City Utah sales tax is 595 the same as the Utah state sales tax. Utah has a 485 sales tax and Salt Lake County collects an additional 135 so the minimum sales tax rate in Salt Lake County is 61999 not including any city or special district taxes.

Salt Lake City 685. What is the sales tax rate in South Salt Lake Utah. Download all Utah sales tax rates by zip code.

What is the sales tax rate in Salt Lake County. 2020 rates included for use while preparing your income tax. The total sales tax rate in any given location can be broken down into state county city and special district rates.

If you would like information on property. The value and property type of your home or business property is determined by the Salt Lake County Assessor. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other.

This is the total of state county and city sales tax rates. The tax rate on food is 3 statewide. This rate includes any state county city and local sales taxes.

The South Salt Lake Utah sales tax is 705 consisting of 470 Utah state sales tax and 235 South Salt Lake local sales taxesThe local sales tax consists of a 135 county sales tax a. Any property unsold at the Tax Sale and which is not in the public interest to be re-certified to a subsequent sale shall become county property. The minimum combined 2022 sales tax rate for North Salt Lake Utah is.

If you dont know the rate download the free lookup tool on this page. The current total local sales tax rate in Salt Lake County UT is 7250. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

The December 2020 total local sales tax rate was also 7250. The 775 sales tax rate in Salt Lake City consists of 48499 Utah state sales tax 135 Salt Lake County sales tax 05 Salt Lake City tax and 105 Special tax. The latest sales tax rate for South Salt Lake UT.

91 rows This page lists the various sales use tax rates effective throughout Utah. 2020 rates included for use while preparing your income tax deduction. Welcome to the Salt Lake County Property Tax website.

Sandy City UT Sales Tax Rate. Utah has state sales tax of 485 and allows local. The December 2020 total local sales tax rate was also 7250.

The certified tax rate is the base. South Jordan UT Sales Tax Rate.

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Utah Tax Rates Rankings Utah State Taxes Tax Foundation

Utah Sales Tax Small Business Guide Truic

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Salt Lake City Utah S Sales Tax Rate Is 7 75

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Sales Taxes In The United States Wikiwand

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Taxes In Orem Utah Orem Sales Tax Rates And Orem Property Tax Rates Orem Ut The Best Guide To Orem Utah

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

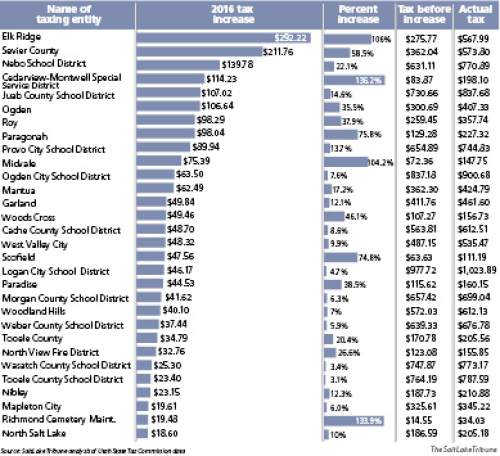

Despite Fuzzy Claims 53 Utah Local Governments Are Proposing Property Tax Hikes The Salt Lake Tribune

What Is The Harris County Sales Tax The Base Rate In Texas Is 6 25

What Renters Should Do Now Before Purchasing A Property Estate Tax Property Tax Tax Deductions

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

Sales Taxes In The United States Wikiwand

The Utah Income Tax Rate Is 4 95 Learn How Much You Will Pay On Your Earnings